No fooling, we’re retooling on April 1st

We’re converting upgrading all of our core processing systems so you’ll have easier, faster and more secure access to your accounts. To facilitate this conversion, we will be closed Tuesday, April 1, 2025, with no branch, phone or digital banking access that day. We’ve included information you'll need to know below. Please bookmark this page as we will continue to provide updates here.

What’s new

- All-new Online Banking, Mobile Banking app and Bill Pay with more features members have requested

- New contactless Debit Cards that are also ready for use with your Digital Wallet

- Instant replacement Debit Cards at branches

- Streamlined and easier-to-read color statements

What remains the same

- Your account numbers and PINS

- Your existing Debit and Credit Cards until the expiration date shown on card

- Your existing printed checks

- Our branch hours, website and friendly staff

Some key points to know

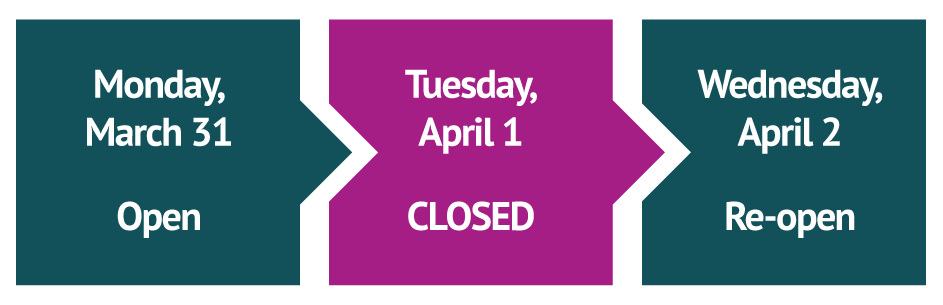

CONVERSION DATE

On April 1, 2025, all branches will be CLOSED with no online or phone access to accounts. All credit and debit cards could be offline with reduced limits on that date. We will re-open branches and bring systems back online Wednesday, April 2, 2025. Outgoing wires and ACH will not be impacted.

Any direct deposits that come in April 1 will be credited to your account on April 2.

PAPER STATEMENT FOR MARCH 31, 2025 STATEMENT

All members — both those that receive e-Statements or mailed statements — will have a March 31, 2025 printed statement mailed to their address of record. Please contact us to be sure we have your current mailing address.

NEW ONLINE BANKING AND MOBILE BANKING APP

Our conversion will bring you enhanced versions of these digital banking tools. Learn about enrolling in our new Online Banking, Mobile Banking App and Bill Pay.

YOUR ACCOUNT NUMBERS WILL REMAIN THE SAME

Your North Bay CU account numbers will remain the same, as will your Debit and Credit Card numbers. You will continue to use the same cards — new cards will NOT be reissued.

NOTE TO ONLINE BANKING AND BILL PAY USERS: DOWNLOAD YOUR HISTORY NOW

Unfortunately, your account transaction history, payment history, payees and related information will NOT transfer over to the new system. Please download your previous statements and all of your current payee and payment information to enter into our new Bill Pay system.

Why a system upgrade

At North Bay Credit Union, we’re continually investing in new technologies that give you greater access, improve our efficiency, and provide even greater account security. You’ll also see we can offer more enhanced services that make banking with us even easier.

How to prepare for our data conversion

- Be sure we have your current email address and phone number, as these are how we will communicate with you during this process. You can update your contact information within Online Banking or by calling (707) 584-0384.

- Have a little extra cash for the conversion day, though we expect you’ll be able to to use your debit and credit cards.

- If you have Bill Payments scheduled for April 1 or 2, we recommend making that payment before March 31. Please note you will need to re-enroll in our new Bill Payment, which you can do in the new Online Banking starting April 2.

- Any Bill Payments scheduled for April 1 will be processed April 2. Again, you may want to make those payments earlier to avoid late charges from the merchant.

Frequently Asked Questions

When will the conversion take place?

April 1, 2025. All branches will be closed and there will be no phone or digital banking access.

Will my personal and financial information remain secure?

Yes, protecting your personal information is always our top concern and this information will remain safe throughout the process.

Will branches be open on conversion day, April 1?

No, all branches will be closed this day and there will be no phone service.

Will North Bay CU ATMs be available?

Yes, our ATMs will be available.

If I have a direct deposit scheduled for April 1, when will the funds be available?

Your direct deposit will be posted to your account on April 2.

Will my North Bay CU member number or account numbers change?

No, these will not change.

Do I need to enroll in the new Online Banking and Bill Pay?

Yes, you will need to enroll before using our new Online Banking And Bill Pay. Learn more here.

Do I need to enroll in the new eStatements?

Yes, you will need to re-enroll, which you can do when you enroll in the new Online Banking.

What happens to my scheduled recurring bill payment that is paid on the first day each month?

Any scheduled bill pay items for April need to either be done prior to April 1 or set up and processed on the new bill pay on April 2.

Will my North Bay CU member number or account numbers change?

No, these will not change.

Will my Bill Payment information and history transfer over to the new system?

Unfortunately, your payment history, payees and related information will NOT transfer over to the new system. Please download your previous statements and all of your current payee and payment information to enter into our new Bill Pay system.

Will my account transaction history and monthly statements from before April 1, 2025 be available in the new portal?

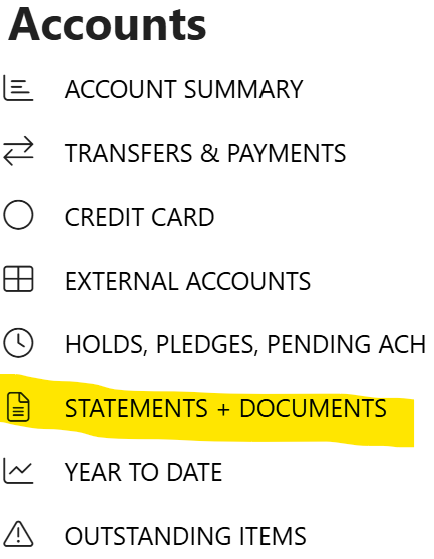

No, but we will archive all historical transaction history and account statements on our internal servers and can produce a previous statement upon request. We advise you to download your historical statements for your records from our current on-line banking program prior to April 1. You can do this under Accounts>Statements+Documents as shown below. All transaction histories and statements produced after April 1, 2025 will be available in the new online banking system.

Will my Debit or Credit Card work during the conversion?

These cards may work on conversion day but limits will be reduced. We do recommend having a little extra cash for the conversion day.

What can I do to ensure I receive important updates?

Be sure we have your current email address and phone number.

What is a core processing system?

The core processing system is the platform that securely manages our major banking functions, including:

- Opening and managing accounts

- Originating and serving loans

- Processing cash deposits and withdrawals

- Maintaining account holder information

- Processing transactions