New Digital Banking is here

Our new core system gives you easier, faster and more secure access to your accounts. There are three things you’ll want to do right now:

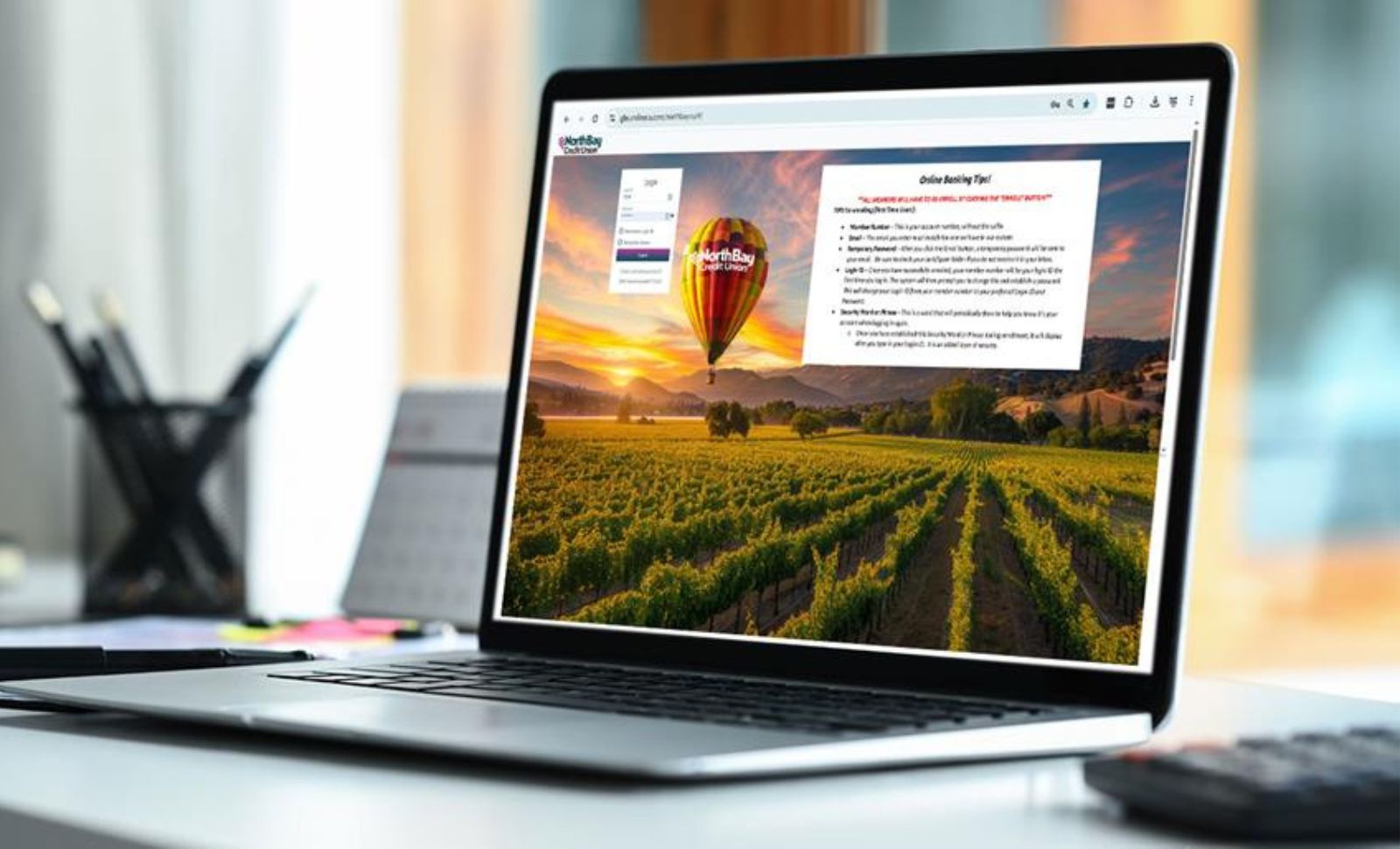

Enroll in all-new Online Banking

All users must enroll in the new Online Banking. Follow the instructions below. You can also enroll in free e-Statements. The email address you use to enroll must match what we have on file for you. If you need to update, contact us now.

- Click the Online Banking button at top right of this page

- Click Enroll

- Enter Member Number, which is your Account Number without a suffix (the digits after the dash) and can be found on your monthly statement or within online banking.

- Enter your email, which must match the one in our system

- After you successfully submit this info, a temporary password will be emailed to you

- At the new Online Banking screen, input your Member Number again as temporary ID, using the temporary password that was emailed. You will then be prompted to select a real Login ID and Password of your choice — it must include a capital letter, a lower case letter and a number.

- You will also be prompted to choose a Security Word or Phrase, which is used when logging in again as an added layer of security.

- After enrolled, you will also need to re-enroll in eStatements, which you can do within the new Online Banking portal.

Delete old Mobile Banking app and install new app

Delete the old NBCU app, then download the new NBCU Mobile Banking App from your App Store below:

Enroll in free Bill Pay

Enrolling in our new Bill Pay is easy. Once logged into our new Online Banking, tap the “Bill Pay” button in the top navigation bar. You will be walked through the steps for adding payees and setting up payments.

At North Bay Credit Union, we’re continually investing in new technologies that give you greater access, improve our efficiency, and provide even greater account security. You’ll also see we can offer more enhanced services that make banking with us even easier.